Question:

I mean, the zakat on trade merchandise is the value of the commodity offered for sale, the value of selling it from the payer of zakat to his customers, not the value that the payer of zakat buys it with!

If I bought 10,000 mobile devices and sold them for 15,000. Zakat is from the 15,000.

Is this correct?!

Answer:

In the Book of Funds: [Zakat on Trading merchandise

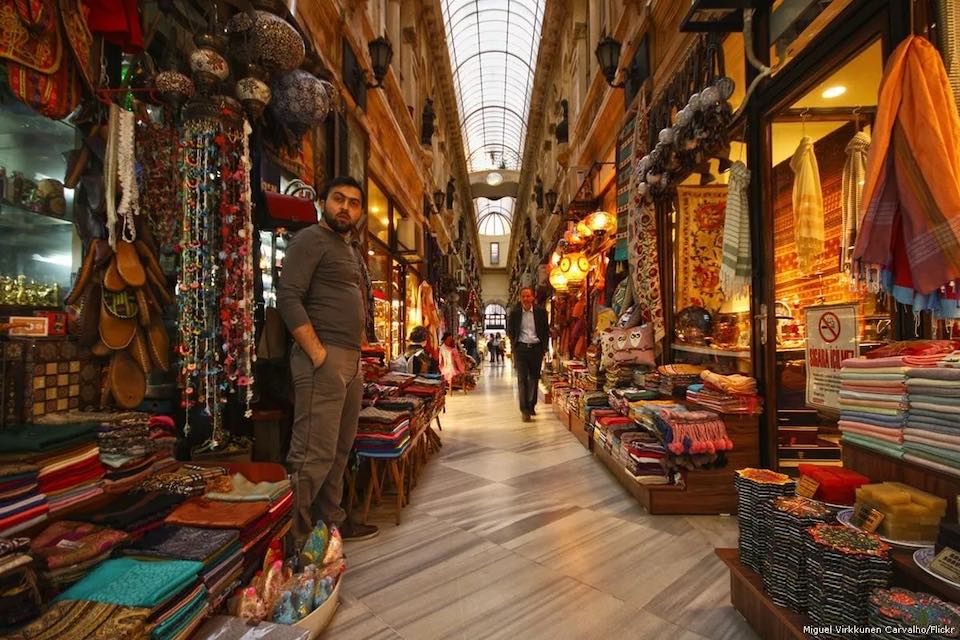

Trade merchandise is everything other than currency which is used for trading, buying and selling, for the sake of profit e.g. foodstuffs, clothing, furniture, manufactured goods, animals, minerals, land, buildings and other goods that are bought and sold.

Zakat is obliged on merchandise taken for trade by the agreement of the early and latter scholars. From Samura b. Jundub who said:

«أَمَّا بَعْدُ، فَإِنَّ رَسُولَ اللَّهِ ﷺ كَانَ يَأْمُرُنَا أَنْ نُخْرِجَ الصَّدَقَةَ مِنَ الَّذِي نُعِدُّ لِلْبَيْعِ»

“See! Verily the Messenger of Allah used to command us to give Sadaqah on what we prepared for sale” (narrated by Abu Dawud). Abu Dharr narrated from the Prophet who said: «وَفِي الْبَزِّ صَدَقَتُهُ» “There is Sadaqah in Bazz.” Narrated by Al-Daraqutni and Al-Bayhaqi. Al-Bazz are clothes and woven material used for trading. Abu ‘Amra b. Hamas narrated from his father who said: “‘Umar ibn Al-Khattab passed by and said: ‘O Hamas, pay the Zakat on your property’. I said: ‘I don’t have any property except for Ji’b (quivers) and leather’. He said: ‘Estimate them, then pay their Zakat.’” AbdurRahman b. Abdul-Qari said: “I was appointed over Bait ul-Mal in the time of ‘Umar ibn Al-Khattab. When the gifts were given out, the wealth of the traders was collected and counted, of what was present or absent. Zakat was then taken from the present wealth for what was present and absent.” From ibn ‘Umar who said: “There is Zakat on Raqeeq (slaves) and Bazz suits upon which trade is intended.” The obligation of Zakat on trade has been narrated from ‘Umar and his son, ibn Abbas, the seven jurists, Al-Hassan, Jabir, Tawus, Al-Nakhai, Ath-Thawri, Al-Awzai, Ashl-Shafii, Ahmad, Abu Ubaid, the people of the opinion (Ashab ar-Rai), Abu Hanifah and others.

Zakat on trading merchandise is obliged when it reaches the Nisab value of gold and silver, and a year has passed over it.

If the trader begins his trade with property less than the Nisab then it reaches the Nisab at the end of the year, there is no Zakat upon it because a year has not passed over it. Zakat will be obliged on its Nisab after a full year has passed over it.

If the trader begins his trade with property above the Nisab such that he begins his trade with 1,000 Dinars then his trade grows and profits by the end of the year so that its value becomes 3,000 Dinars, it is obligatory upon him to pay Zakat on 3,000 Dinars not the 1,000 Dinars he started with. This is because its profit follows it i.e. the origin, and the period of one year of generated profit is the same as the period of one year of the origin. This is like, the goats’ offspring (Sikhal), and offspring of sheep (Baham), that are counted together with them, because their period of one year (Hawl) is that of their mothers. Similar to this is the profit on wealth so its time (Hawl) is the period of one year of the origin from which profits were derived. When the year finishes the trader estimates his trading merchandise whether Zakat is obliged upon it because of itself such as camels, cattle, and sheep, or not, such as clothes, manufactured products, land and buildings. He estimates them collectively in gold or silver units. He then gives quarter-tithe if it reaches the Nisab value of gold or silver, giving the obligatory Zakat in the used currency.

It is allowed for him to give its Zakat from the merchandise itself if that is easier for him, e.g. where he is trading with sheep/goats, cattle or clothes and the value of the Zakat obliged upon him is estimated in sheep, cattle or clothes, he may give its Zakat in currency or he may give it in sheep, cattle or clothes i.e. he may give whichever he wishes.

Zakat on trading merchandise, on whose assets Zakat is due like camels, cattle and sheep/goats, is paid as Zakat of trading merchandise, not as Zakat of livestock. This is because trade is intended in their ownership, not mere possession…]. END.

Thus, the trade is estimated at the beginning, and if it is the nisab or more, this is counted as the beginning of the year and at the end of the year it is done again, then its zakat is paid according to the estimation when zakat is due, and as mentioned above, the profit is included when calculating the value of the trade even if one year has not passed, because the profit is related to the capital.

That is, the trade estimation is at the beginning of the nisab, then after the end of the year from the beginning of the nisab, that is, when zakat is due.

I hope this is enough, and Allah is All-Knowing and Most Wise.

Your brother,

Ata Bin Khalil Abu Al-Rashtah

28 Sha’ban 1444 AH

Corresponding to 20/03/2023 CE